By Adam Andrzejewski

In 2022, our auditors at OpenTheBooks.com filed 50,000 Freedom of Information Act requests – the most in American history – and captured nearly every dime taxed and spent at the federal, state and local levels of government.

Following the midterm election results last month, here are five oversight priorities for the 118th Congress – or any governor – to investigate, address and reform.

(Furthermore, our reports and investigations serve as a blueprint so taxpayers can demand spending reforms. Remember, it’s your money!)

Priority 1: Drain The Swamps — Federal, State, and Local

Supersized Pay – from salary to benefits, pensions, and perks, public employee compensation across the country is unsustainable.

We found Dr. Anthony Fauci was the top paid federal employee and out earned the president; his wife, Christine Grady, as the chief bio-ethicist at National Institutes of Health (NIH), out earned the vice-president; and when Fauci retires in two weeks, he'll reap the largest golden parachute federal pension in history at an estimated $375,000 per year.

Then, we showed exactly how Fauci profited during the pandemic, as Fauci’s household net worth increased from $7.6 million to $12.6 million (2019-2021) – driven in part by accepting a $1 million prize from a foreign non-profit.

At the state level, we found life’s a beach if you’re a lifeguard in Los Angeles County. In 2021, top paid LA lifeguards earned up to $510,283 and 98 earned at least $200,000. After three decades of service, they can retire as young as 55 and continue making 79 percent of their pay.

In Illinois, 132,000 public employees and retirees made $100,000 costing taxpayers $17 billion. Wild examples included a community college professor who earns more than President Biden; small town and village managers who out earn all 50 U.S. governors; 378 Chicago bus drivers, prison barbers and janitors all made the six-figure club, along with rail workers and auto pound bosses; and public-school superintendents had salaries or pensions up to $434,000.

In Metro-Nashville, 200 city employees double-dip the pay and pension systems. They retire on a full pension and get hired back part-time – at their full-time wage scale. Therefore, it’s a pay raise to retire – with many making more working half-time in ‘retirement’ than they did working full-time!

Governors need to examine their processes for negotiating public union contracts, and work with legislators to ensure proper allocation of taxpayer funded spending.

Here’s a refresher on these investigations:

* BREAKING: Fauci’s Net Worth Soared to $12.6 Million During Pandemic – Up $5 Million (2019-2021)

* Top-Paid LA Lifeguards Made Up to $510,283 in 2021

* Why Illinois is In Trouble: 132,188 Employees With $100,000 Paychecks Cost Taxpayers $17 Billion

* Metro-Nashville Double Dippers

Priority 2: Open The Books — Secret Third-Party Royalties & Operations At The National Institutes of Health (NIH)

Since FY2010, the NIH, its leaders, and 2,405 of its scientists received $325 million in hidden, third-party royalty payments.

We launched this investigation with a FOIA request and the agency ignored it. So, we sued them in federal court with Judicial Watch and received 3,000 pages of line-by-line royalty payments since 2010. (However, the agency hid — heavily redacted — the company or entity making the payment; the amount each individual scientist received; and the patent/license number of the medical innovation!)

Each year the NIH doles out over $30 billion in grants to researchers, medical companies, pharmaceutical firms, and the healthcare industry writ large. Coming back through the other door – is the hidden $325 million in royalties that enriched the agency, its leaders, and its scientists. We need to be able to follow the money.

Similarly, NIH forced us to file federal lawsuits for Fauci’s basic employment information such as job description, ethics and financial disclosures, employment agreement, waivers, etc. Agency duties regarding annual employment reviews were also not produced. Was Fauci unreviewable and unaccountable?

NIH also forced us to sue regarding the employment documents for Fauci’s wife, Christine Grady, the chief bio-ethicist at NIH. While Dr. Fauci was crafting the nation’s healthcare response to Covid, his wife was backstopping the policies with ethics studies. Currently, it’s all hidden. Why?

Here’s a refresher on the investigation:

*Fauci’s Royalties and the $350 Million Royalty Payment Stream HIDDEN by NIH

Priority 3: Reverse The Government’s War On Transparency

While politicians continue promising to be the “most transparent” ever, the reality is that secrecy and refusal to answer public information requests keeps growing. The Office of Personnel Management (OPM) redacted 350,000 federal executive agency employee names from our Freedom of Information Act (FOIA) request—roughly $30 billion in compensation that goes unaccounted for. For comparison, in the last year of the Obama administration, only 2,367 names were redacted. OPM stated,

“For those instances where data elements are not released, they are being withheld under FOIA Exemption 6… the disclosure of which would constitute a clearly unwarranted invasion of personal privacy.”

It’s not personal privacy when you’re paid by taxpayers! Although OPM is the biggest culprit, it’s not the boldest and it’s not alone.

The Federal Reserve employs 23,000 people, but only gave us 367 executive salaries. Apparently, the Federal Reserve believes they are exempt from the law. They stated:

“Releasing the names and specific salary information for all employees would not shed any further light on the Board’s performance of its statutory duties.”

What does the Board’s performance have to do with our FOIA request? AND they told us that a database of their expenditures—a checkbook—does not exist:

“Staff searched Board records and made suitable inquiries with knowledgeable staff but did not locate the information you seek.”

This from our country’s central bank! 23,000 employees! No database of expenditures!

The U.S. Postal Service (USPS) also refused to produce a checkbook, stating that doing so would expose their “trade secrets.” Given that USPS is a money-losing enterprise, it’s hard to imagine any “trade secrets” that FedEx or UPS want to get their hands on!

Finally, the baldest example is the Office of the Vice President. They claimed,

“The Office of Vice President is not subject to Freedom of Information Act requests.”

One would think the Vice President would want you, taxpaying voters, to know how they spent your tax dollars. Not so. Why?

Action Plan: It’s time for Congress to strengthen FOIA law, and to hold agencies and departments accountable for refusing requests or abusing exemptions.

Here’s a refresher on the investigation:

* Wall Street Journal: The Government’s War on Transparency

Priority 4: Declare War On Waste — Republican Earmark-Lovers, Federal Pork & Waste

Earmarks, The Currency of Corruption in Congress: last week, the new Republican caucus in Congress held a secret vote on earmarks. A secret vote! It is hard to imagine a Republican member – who is supposed to be concerned about the exploding debt, about the irresponsible spending – even participating in a secret vote on how they spend your tax dollars. Yet, 150 earmark-loving Republican members of Congress voted to embrace earmarks.

It’s a target rich environment for taxpayer abuse.

We detail some egregious examples in our oversight report, Where’s the Pork? The IRS cut economic stimulus checks to 2.2 million deceased people without checking the deceased persons list at Social Security. The Small Business Administration doled out 57,000 PPP loans to entities on the Do Not Pay List at the U.S. Treasury. Each mistake cost taxpayers $3.5 billion!

Then there were oddball grants given for anything from teaching pigeons how to gamble to studying the hydrodynamics of defecation. Yes, you read that correctly.

Dr. Anthony Fauci’s Institute of Allergies and Infectious Diseases spent $478,188 in an attempt turn monkeys transgender, the National Science Foundation gave a $300,000 grant for a virtual reality penguin study and gave Harvard $75,000 grant to “blow lizards off trees with leaf blowers.”

We also found 126 of the Top 300 law firms and 236 of the Top 300 Accounting firms received $1.4 billion in forgiven PPP loans. These firms demonstrated little or no financial hardship during the pandemic as they had hundreds of millions in revenues and partners made millions of dollars in equity profits!

Here’s a refresher on the investigation:

* Oversight Report: Where’s the Pork?

* Substack: Just How Much Federal Pork and Waste Are Your Tax Dollars Funding?

* New York Post: Watchdog Calls Out Government’s Most Ridiculous Spending

* Forbes: Speaker Nancy Pelosi Dished Out $370 Million In Earmarks To 23 Newly Elected Republican Freshman

* Substack: $1.4 Billion In Forgiven PPP Loans Paid To Wealthiest Law And Accounting Firms

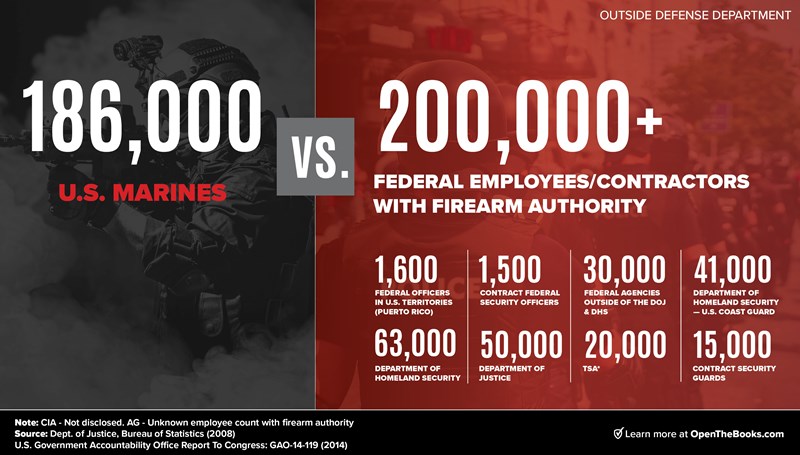

Priority 5: Investigate, Limit The Militarization Of U.S. Executive Agencies

Between 2006 and 2019, 103 federal agencies outside of the Department of Defense spent $2.7 billion on guns, ammunition, and military-style equipment (inflation adjusted). Nearly $1 billion ($944.9 million) was spent between fiscal years 2015 and 2019 alone.

We estimate that there are now more federal officers with arrest and firearm authority (200,000 ) than U.S. Marines (182,000).

76 administrative agencies spent $110.6 million on guns, ammunition, and military-style equipment between fiscal years 2015 and 2019. Examples included the Internal Revenue Service, Veterans Affairs, Executive Office of the President, Small Business Administration (SBA), Smithsonian Institution, Social Security Administration, National Oceanic and Atmospheric Administration, and the Animal Health Inspection Service.

Frequently, we found weak controls in place. For example, Department of Homeland Security lost 228 guns in the most recent audited three-year period, along with 1,889 badges and 25 secure immigration stamps.

The IRS already employs 2,159 “Special Agents” and the agency spent $21.3 million on guns, ammunition and military-style equipment between fiscal years 2006 and 2019. The agency stockpiled five million rounds of ammunition and 4,500 guns including hundreds of shotguns, rifles, and 15 submachine guns.

After the passage of the Inflation Reduction Act, the IRS will double its workforce and add 87,000 new employees.

Here’s a refresher on the investigation:

* The Militarization of The U.S. Executive Agencies: OpenTheBooks Oversight Report

* Why Does The IRS Need Guns? – Wall Street Journal

CONCLUSION

We are not going to address this massive, irresponsible spending from the top down. It has to begin with you, the taxpayers. We have to change the culture within government. It starts with asking your members of Congress, your Senators, your state legislators, and your governor to get to work.

You have all the fact and figures at your disposal. Whether it’s our online database or our on-demand smartphone app – OpenTheBooks for Apple and Android—the hard facts are at your fingertips or in your pocket.

This to-do list is just a start, and it’s an agenda that’s tangible. As always, we’ll be there this year and beyond to demand accountability for taxpayers!